what is a deferred tax provision

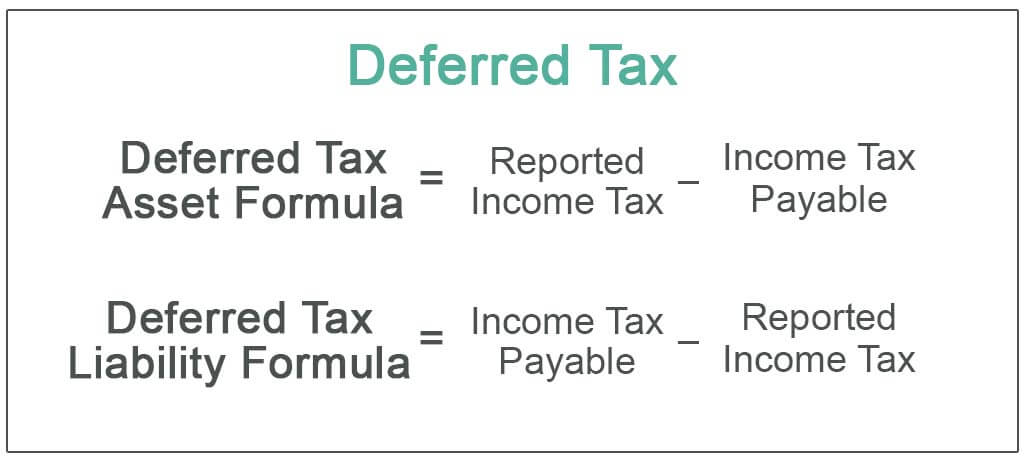

The deferred income tax is a liability that the company has on. Deferred tax is the amount of tax payable or recoverable in future reporting periods as a result of transactions or events recognised in current or previous periods accounts.

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Deferred income tax expense.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

. In this article we will see why a company may differ its tax to. In the preceding example. Deferred tax is a balance sheet line item which is recorded because the Company owes or pay more tax to the authorities.

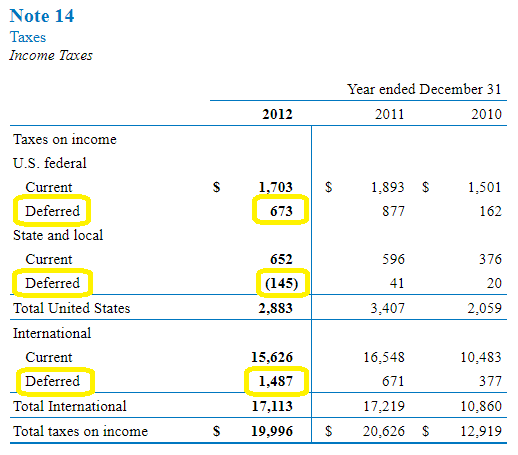

Deferred tax refers to income tax overpaid or owed due to the temporary differences between accounting income and taxable income. This article Deferred tax provisions 123 kb sets out four key areas of your tax provision that could be affected by the impacts of COVID-19. These entries adjusted my deferred tax State and Fed accounts as well as Fed and State overpayment and expense accounts.

Tax base 1000000 10000005 800000. However it is the profit in accounting base so we have to make adjustment to determine. 330 lacs DTL newly calculated.

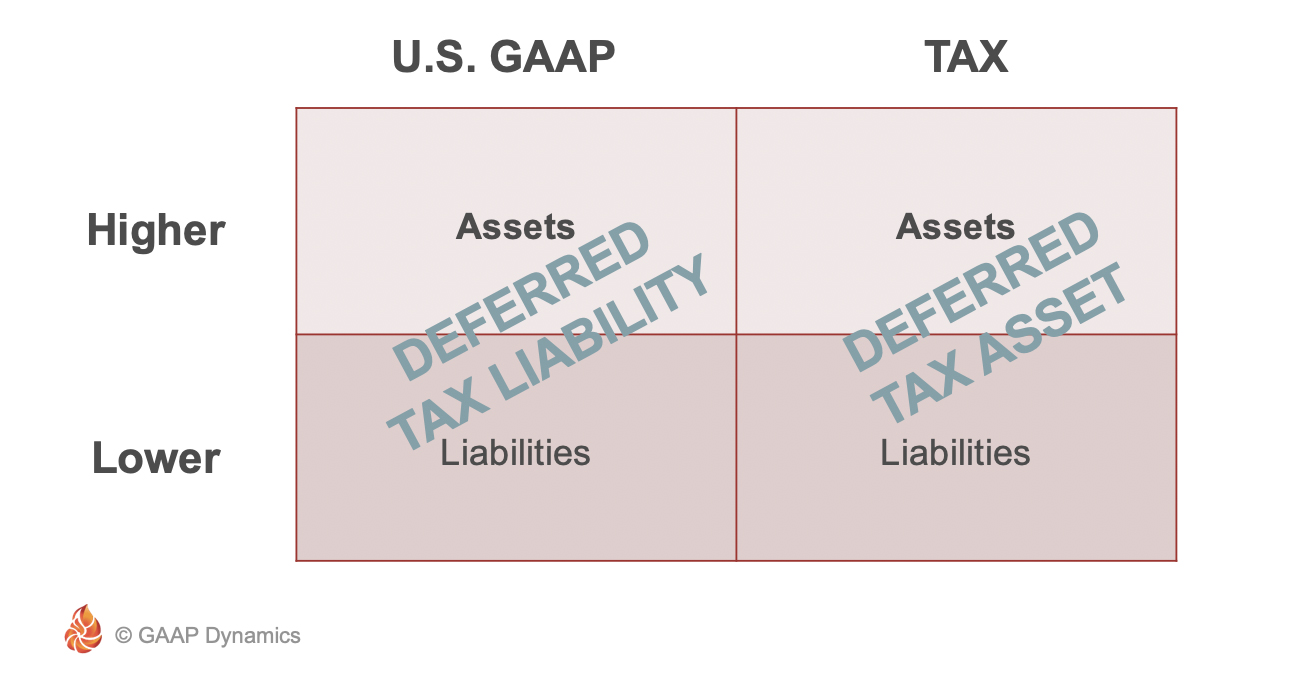

Deferred tax can fall into one of two categories. Deferred tax asset is an accounting term that refers to a situation where a business has overpaid taxes or taxes paid in advance on its balance sheet. Another example of Deferred tax assets is Bad Debt.

Usually this results in no net change to the ASC 740. Temporary differences create deferred tax assets or liabilities because their reversal affects future tax expense. Decrease the book profit by the amount of deferred tax if at all such an amount appears on the.

For deferred tax purposes such a disallowance could be regarded as either permanent or timing depending on the circumstances. A provision for deferred tax. A deferred tax liability is an account on a companys balance sheet that is a result of temporary differences between the companys accounting and.

Both will appear as entries on a balance sheet and represent the negative and positive. A deferred tax asset is a future tax benefit in that deductions not allowed in the current period may be realized in some future period. Increase the book profit by the amount of deferred tax and its provision or.

The only one entry will be passed in books for Rs. The result is your companys current year tax expense for the income tax provision. Calculating the cumulative total of all temporary differences using.

I recorded return to provision entries. The deferred income tax is a charge on the balance sheet of the company but is not required to be repaid. Deferred Tax Liability.

More specifically we focus on. Profit Loss AC DR. Lets assume that a company has a book profit of 10000 for a financial year including a provision of 500 as bad debt.

So there is a deferred tax liability of Rs. A deferred income tax is a liability recorded on the balance sheet that results from a difference in income recognition between tax laws and accounting. Definition of Deferred Tax.

It is part of the. Lets look at an example. The term deferred tax refers to a tax which shall either be paid in future or has already been settled in advance.

A provision is created when deferred tax is charged to the profit and loss account and this provision is reduced as the timing difference reduces. The deferred tax represents the negative or positive. Deferred tax liabilities and deferred tax assets.

Deferred Income Tax. Deferred tax income for current year 5000 5000-0 The company profit before tax is 80000. 330 lacs for current year.

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Net Operating Losses Deferred Tax Assets Tutorial

What Is A Deferred Tax Liability Dtl Definition Meaning Example

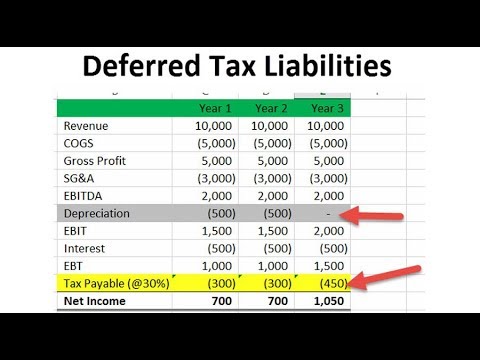

Deferred Tax Liabilities Meaning Example How To Calculate

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Worked Example Accounting For Deferred Tax Assets The Footnotes Analyst

Define Deferred Tax Liability Or Asset Accounting Clarified

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Deferred Tax Asset Journal Entry How To Recognize

Deferred Tax Meaning Expense Examples Calculation

Deferred Tax Double Entry Bookkeeping

Deferred Tax Liabilities Meaning Example How To Calculate

Deferred Tax Liabilities Meaning Example Causes And More

Deferred Tax Asset Journal Entry How To Recognize

Deferred Income Tax Liabilities Explained With Real Life Example In A 10 K

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)